BDC Daily Update: Wednesday October 27, 2021

MARKETS

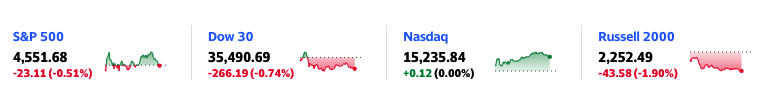

At least for a day, the relentless upward movement of the major indices reversed itself. With the S&P 500, the Dow Jones and the Russell 2000 all down by varying percentages, as shown above. (The NASDAQ was the exception to the rule, moving up and reaching a new all-time high). Still, the S&P 500 is still up 5.6% for the month, with two business days to go.

BDC sector prices fell as well, judging by what happened to BDCZ and BIZD. The former – the UBS-sponsored Exchange Traded Note which owns most BDC stocks – fell to $20.00 a share, down (0.22%). The latter – the Van Eck sponsored ETF for the BDC sector – moved to $17.51, down by (0.28%).

14 BDCs moved up in price and 28 moved down. The biggest winner in percentage terms was newly publicly-listed Cion Investment (CION), getting a much needed price boost, up 2.85%. Volume was below average. Number two was Horizon Technology Finance (HRZN) which, as we presaged in yesterday’s Daily Update – got a boost from announcing good results and a special dividend of $0.05. The stock was up $0.44 per share to $17.57, but still below its 52 week high of $17.95. The remaining BDC stocks in the black barely increased. To the downside, even the largest percentage loss was modest: PennantPark Investment (PNNT), off (1.31%). Investors continue to hold back, committed neither to moving forward or falling back.

Still, 2 BDCs reached new 52 week highs. Once again, the market leader Ares Capital (ARCC) – which accounts for 18% of BIZD – broke its 52 week and all-time record, reaching $21.64. ARCC was joined by TriplePoint Venture Growth (TPVG), which reached $18.06, easily breaking through the prior high of $17.89.

BDC sector prices as a group continue to be just below their highs set in mid-June.

NEWS

As we noted yesterday, HRZN held its conference call this morning. Helped by a brief period of quiet between earnings releases, the BDC Reporter used the opportunity to annotate the transcript of the meeting. Click here for the full article.

After the bell, Logan Ridge Finance (LRFC) had important news. The very small cap BDC (market capitalization: $68mn)announced raising $50mn in new unsecured debt. The notes are privately placed, yield 5.25%, mature in 2026 and boast an Egan-Jones rating of BBB-.

LRFC – as readers know – is the former Capitala Finance, and has to contend with two sets of public debt issues – CPTAL and CPTAG – coming due in May 2022 – just round the corner in fixed income terms. As you’d expect, LRFC indicated that the intended use of proceeds is “to repay certain indebtedness, including to redeem a portion of the outstanding 2022 Notes, and for general corporate purposes“.

We noticed the “portion” language in the press release. That’s because CPTAL – the only one of the two debt issues that can be redeemed at this point – has outstandings of $73mn. LRFC is expecting to receive only $49mn. We imagine the difference will likely come from cash. As of June 2021, LRFC already had $26mn in cash and has been on a selling spree since, suggesting coming up with the funds to pay off CPTAL in full will not be a problem.

Another benefit to LRFC – and its shareholders – will be a lower cost of debt capital thanks to this offering, but not too much. CPTAL yields 6.00%, so LRFC will gain a benefit of 0.75% on the $73mn to be repaid. We calculate the interest savings will be just over a quarter of a million dollars. “Better than a slap in the belly with a wet fish” – as the saying goes – but not a very drastic improvement on a cost basis.

Still unclear is what LRFC’s balance sheet looks like in toto going forward. Currently, the BDC’s only senior secured financing is fully drawn at $25mn. However, $52mn has to be raised by May to repay CPTAG. To date, management has pledged $84mn in assets to secure the revolver. Will LRFC seek to arrange another secured facility with its remaining $144mn of portfolio assets. That might prove just enough to raise sufficient capital to pay off CPTAG, but would leave nothing for anything else.

More appropriate, and more likely, would be an attempt to issue a second unsecured note for $50mn or so. That would leave LRFC with roughly $225mn of portfolio assets, funded by $25mn of secured debt and $100mn of unsecured notes. Roughly speaking, that’s asset coverage of debt of 180%, well above the 150% statutory requirement for BDCs. Of course, that wouldn’t be much different than the situation currently, except for longer maturities and slightly lower borrowing costs.

This would leave LRFC’s borrowing cost at about 5.0%. Add to that 1.75% of management fees, operating costs and the incentive fee and not many investment dollars will drop to the bottom line.

Management could have entirely different plans so take the above as the BDC Reporter’s initial musings. We’ll learn more about the advisor’s plans for the BDC when IIIQ 2021 results are posted and discussed shortly.

As of today LRFC is trading at $25.11, not far off its 52 week high of $28.90 but still at a (40%) discount to net book value per share, reflecting investor doubts about the BDC’s earning power with this sort of economics.

Already a Member? Log In

Register for the BDC Reporter

The BDC Reporter has been writing about the changing Business Development Company landscape for a decade. We’ve become the leading publication on the BDC industry, with several thousand readers every month. We offer a broad range of free articles like this one, brought to you by an industry veteran and professional investor with 30 years of leveraged finance experience. All you have to do is register, so we can learn a little more about you and your interests. Registration will take only a few seconds.